Bad Credit Loans - Exactly How To Get A Bad Credit Scores Loan

Article writer-Appel Andrews

If you need money now however have a poor credit rating, you might get approved for a bad credit score finance. Negative credit loans are offered from several loan providers. https://www.denverpost.com/2021/08/20/best-online-same-day-loans-for-bad-credit-and-payday-loans-alternative/ is necessary to discover one that fits your budget and your circumstances. When picking a lending, keep in mind that poor credit is not a deal breaker. It is just a fact of life that you need cash. In case you require to borrow cash for an emergency situation, you ought to compare the choices and also make certain you can repay them.

On-line loaning companies imitate typical financial institutions without the physical areas. They have quick decision-making processes and also can deposit funds into your checking account within a few hrs or days. Unlike traditional banks, numerous online loan providers don't call for application charges or early repayment charges. Once you have actually determined to take out a negative credit rating finance, there are a number of points to bear in mind. Among the first things to remember is the repayment term. The quantity you can obtain might be between one and also 5 years.

When getting a negative credit scores funding, it is necessary to keep in mind that your credit report will influence your qualification for the car loan and also the rate of interest. If your credit history is less than 500, you'll have a much more challenging time getting approved for a car loan. Because of this, you ought to intend to boost it as much as you can. As soon as you have a high rating, you will get approved for much better rates. When making an application for a negative debt financing, remember that there are several advantages.

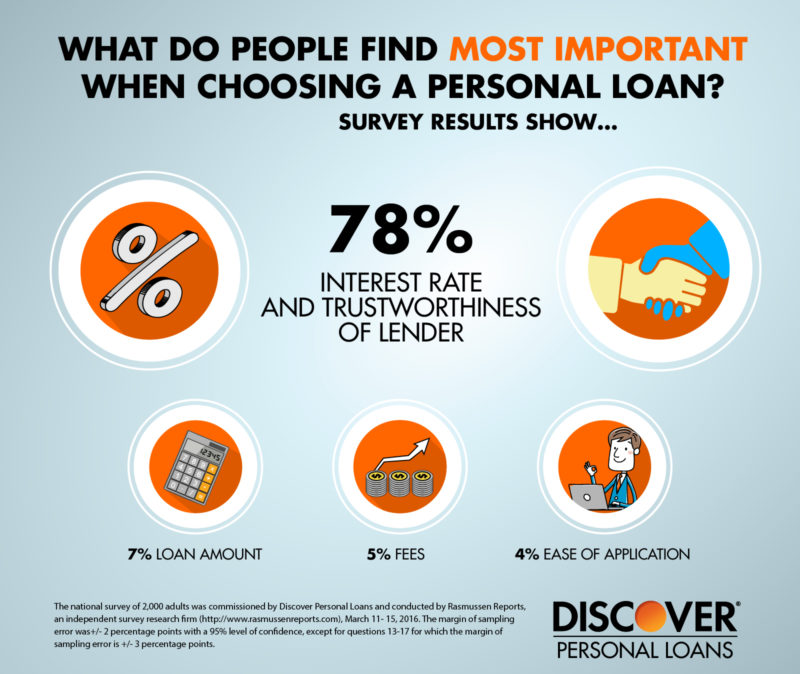

When looking for a negative credit score funding, remember to seek a lender that is trustworthy. Search for lenders that sign up in the exact same state where they operate. A genuine loan provider will not ask you to pay specific individuals. Some of the scammers will certainly also call you up as well as request for your bank account information. Then, when applying for a bad credit history car loan, seek a lending institution that will certainly ask for a small upfront fee for refining the application.

When making an application for a financing, keep in mind that the amount you get depends upon your financial circumstance and credit rating. Borrowers with lower credit report can still receive a tiny financing. The total expense of the financing is based on the amount of money you obtain, the settlement terms, as well as the interest rate. The interest rate (APR) is an estimation based on your car loan quantity, the interest rate, charges, and also the size of time it takes to repay it. APRs are higher for poor credit scores fundings than forever credit report.

Before applying for a negative credit rating financing, you have to research your alternatives. The Net is a terrific place to start, as many lending institutions provide bad credit loans online. Check out financial companies that specialize in these fundings and figure out if they use poor credit score car loans in your state. Once you've picked a couple of lenders, it's time to compare quotes. Take your time as well as look for a funding that fits your needs. A poor credit score finance can help you get through an emergency.

Prior to obtaining a poor credit history finance, you ought to talk to a monetary expert. There are numerous alternatives readily available to you, and you need to select one based upon your individual situations. Consult your neighborhood BBB to guarantee that the loan provider you're collaborating with is legit. You need to also take into consideration looking into personal lendings websites that deal with several lending institutions. While this website does not have a BBB certification, it uses fair loans with practical APRs as well as repayment terms.

A personal line of credit works just like a bank card, with the advantage that the consumer only pays rate of interest accurate that they actually spend. Unlike the majority of other individual lendings, line of credits provide the customer the versatility to choose an amount that best fulfills their demands. Additionally, you can ask for extra funds as your balance is repaid. more resources of financing is a terrific alternative for those with negative credit scores since the rates of interest on the money is not high.

While family loans are one of the most informal means to obtain an individual loan, it is important to be knowledgeable about the tax consequences. just click the following web site of the family are not likely to put you with a strenuous certifying process as well as will most likely reduce corners on rate of interest. Stopping working to pay off a finance to a close partner can wear away the partnership. As a result, it is very important to deal with obtaining money from member of the family like any other service deal. You need to compose a formal agreement with them that mentions the finance terms, rates of interest, payment choices, and repayment terms.